Bitcoin Dominance is a metric that tells us about Bitcoin's share in the total market capitalization of all cryptocurrencies. It is an essential indicator for investors and traders as it provides a clear view of Bitcoin's position and influence in the broader crypto market. Understanding Bitcoin dominance helps in making informed decisions regarding portfolio diversification and risk assessment.

Bitcoin, being the pioneer cryptocurrency, holds a pivotal role in the crypto landscape. Its market dominance can signal investor sentiment and market direction. High Bitcoin dominance suggests that investors are favoring Bitcoin over altcoins, possibly viewing it as a safe haven during market volatility. Conversely, a declining Bitcoin dominance indicates increasing investor interest in altcoins, which might be seen during times of bullish market trends.

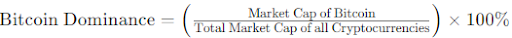

Bitcoin dominance is calculated by dividing Bitcoin’s market capitalization by the market capitalization of all cryptocurrencies combined. This ratio is then expressed as a percentage:

This simple formula provides a snapshot of Bitcoin's relative strength and can influence investment strategies across the crypto market.

On our website, we feature a real-time Bitcoin Dominance chart that visualizes Bitcoin's market share over time. This chart is a powerful tool for identifying trends and potential shifts in market dynamics. By analyzing past movements, investors can anticipate future changes and adjust their strategies accordingly.

Changes in Bitcoin dominance can significantly affect the crypto market, influencing the prices of altcoins and overall market liquidity. A high dominance typically suppresses altcoin prices as capital concentrates in Bitcoin. On the other hand, when Bitcoin’s dominance wanes, altcoins often experience growth, attracting diverse investments.

Investors might use Bitcoin dominance trends to adjust their investment portfolios. For example, a rising dominance could signal a time to increase Bitcoin holdings, whereas a falling dominance might suggest diversifying into altcoins. Additionally, traders might use dominance trends to predict bullish or bearish market conditions, adjusting their positions to mitigate risk or capitalize on potential gains.

As Bitcoin continues to evolve and shape the financial landscape, staying informed about its market dominance is crucial for anyone involved in the crypto market. We invite you to explore our additional resources, sign up for real-time updates, and dive deeper into our analyses on the significance of Bitcoin dominance. Discover how shifts in this key metric can offer opportunities and challenges in the dynamic world of cryptocurrency investing.